The industrial robot market witnessed a notable milestone in 2023 as global shipment volumes exceeded 500,000 units, according to Interact Analysis. Despite facing significant challenges in recent years, including the impact of the COVID-19 pandemic and inflation, the industry is beginning to recover. This resurgence reflects a broader trend towards automation and technological advancement in various manufacturing sectors globally.

Industrial robots are automated machines designed to perform various tasks in manufacturing and production environments, often replacing or assisting human labor. These robots are widely used in sectors such as automotive, electronics, and metalworking, where precision and efficiency are crucial. Launched in the mid-20th century, industrial robots have evolved significantly in terms of capabilities and applications, driven by advancements in technology and increasing demand for automation in industrial processes.

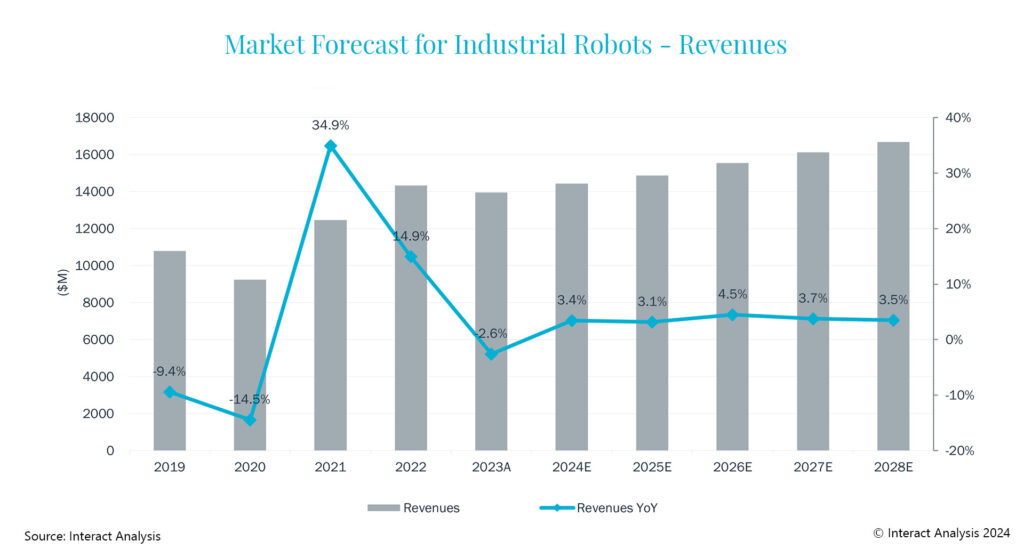

Past reports indicate that the industrial robot market reached record highs in 2021 but experienced a decline in 2023 in terms of revenues and shipments. The average price per unit for industrial robots decreased last year, a trend that is expected to continue with a projected annual decline of around 3% between 2024 and 2028. Supply chain issues and inflation had previously kept prices high in 2022, but current data suggest a positive long-term outlook. Interact Analysis predicts an average market growth of 3.7% per year from 2024 to 2028.

Regional Market Dynamics

In the Americas, industrial robot sales to the automotive sector faced substantial pressure in 2023, resulting in slow growth. This trend was particularly pronounced in Mexico, reflecting the region’s heavy reliance on automotive manufacturing. While the Americas saw a 17.3% decrease in industrial robot market growth, APAC experienced a slight increase, and EMEA remained stable. Notably, the Americas accounted for 17% of global revenues, compared to 62% for APAC and 22% for EMEA.

The American market displayed robust growth immediately after the COVID-19 pandemic in both automotive and non-automotive industries. This was driven by manufacturers’ pursuit of improved production processes and cost reductions through the adoption of industrial robots.

Predominant Applications

Material handling, welding, and assembly are identified as the top three applications for industrial robots. These applications contributed over 70% of the market revenues in 2023, with material handling alone accounting for one-third. The dominance of these applications is particularly notable in the Americas and Europe, where the top five suppliers hold a significant market share.

The Association for Advancing Automation (A3) reported that robot sales in North America declined by 6% in the first quarter of 2024 compared to the same period in 2023. Companies in North America purchased 8,582 robots, amounting to $494 million in sales from January to March 2024.

The industrial robot market is poised for steady growth despite facing recent challenges. The decline in average robot prices and the anticipated market growth rate provide a favorable outlook. However, regional disparities in market performance and the varying impact of economic factors like inflation and supply chain issues highlight the complexity of the industrial robot market. Continued technological advancements and the drive for automation across industries are likely to sustain the upward trajectory of robot adoption globally.