Google-Backed GitLab, a U.S. provider of cloud-based software development tools, is exploring a potential sale following acquisition interest. The company, valued at approximately $8 billion, is collaborating with investment bankers to navigate the sale process. While specific agreements are yet to be finalized, sources indicate that the company has garnered interest from various peers, including Datadog. This exploration follows GitLab’s notable market presence, serving over 30 million registered users and more than half of the Fortune 100 companies.

GitLab has consistently reported strong financial performance, including a 33% year-on-year revenue growth to $169.2 million and its first-ever positive cash flow in recent quarters. Despite this, the company’s shares have seen a 16% decline this year, underperforming against the S&P 500 Application Software index. This dip has raised concerns about customer spending and pricing challenges, especially in competition with Microsoft following its acquisition of GitHub. Historically, GitLab’s robust financial performance and strategic acquisitions, like Oxeye, have bolstered its capabilities in application security and governance, enhancing its market position.

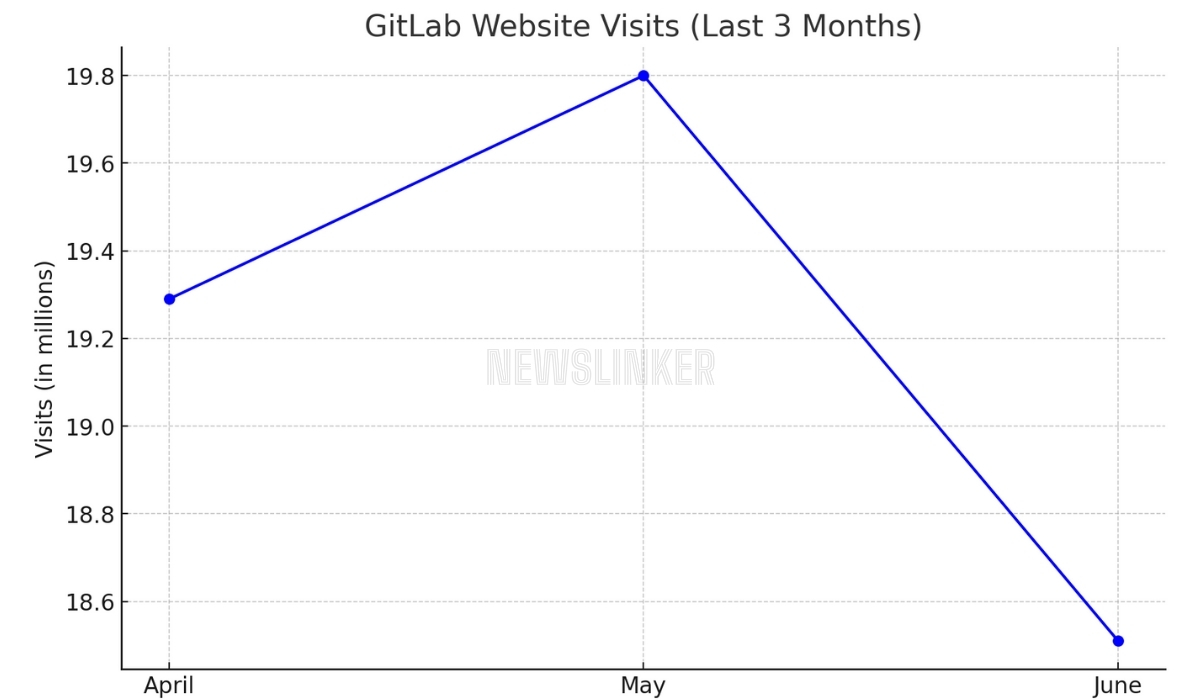

The graph illustrates the number of visits to GitLab’s website over the past three months. In April, the site recorded 19.29 million visits. This figure slightly increased to 19.80 million visits in May. However, June saw a decrease, with visits dropping to 18.51 million.

Industry Dynamics and M&A Activity

The technology sector has witnessed a surge in mergers and acquisitions, driven by advancements in artificial intelligence and cloud computing. Alphabet, a major investor in GitLab with a 22.2% voting stake, is actively participating in the M&A landscape, recently engaging in talks to acquire cybersecurity startup Wiz for about $23 billion. The sector accounted for the largest share of global M&A activity in the first half of 2024, with transactions totaling $327.2 billion, a 42% increase from the previous year.

Datadog, another potential acquirer, offers software that aids technology workers in collaboration and productivity measurement using the cloud. With a market value of $44 billion, Datadog’s interest in GitLab underscores the growing trend of consolidation in the tech industry. GitLab’s market strategy and financial health make it an attractive acquisition target, aligning with broader industry trends where companies seek to expand their service offerings and capabilities through strategic acquisitions.

GitLab’s Strategic Moves

GitLab’s focus on enhancing its DevSecOps platform through acquisitions like Oxeye highlights its commitment to improving security and compliance tools. Oxeye’s capabilities in automated cloud-native application security testing have fortified GitLab’s position in the market, enabling it to offer comprehensive solutions across the software development lifecycle. These strategic moves have positioned GitLab as a leader in integrated software delivery platforms, recognized by independent research firms for its robust and secure development tools.

CEO and co-founder Sid Sijbrandij’s announcement about undergoing treatment for osteosarcoma and his continued commitment to his duties reflects the company’s stability and leadership. Despite market fluctuations and competitive pressures, GitLab remains focused on delivering value to its customers and maintaining its growth trajectory. The potential sale could provide opportunities for further expansion and innovation, benefitting its extensive user base and solidifying its market position.