Companies across North America have accelerated their adoption of industrial robots in 2025, signaling ongoing interest in automation despite a previous year’s downturn. As organizations adapt to shifting economic pressures, many see automation not just as a labor-saving tool but as a strategy for remaining competitive in evolving markets. Emerging technologies and increasing investments have motivated sectors outside of automotive to incorporate robotics more systematically, changing the landscape of industrial automation.

Earlier figures about North American robot orders revealed a slower recovery following disruption in 2024. Analysts previously noted uneven gains, with automotive manufacturing traditionally dominating the market. However, the current data reflects a clear shift, as broader industries, particularly those involved in food, electronics, and consumer goods, are now driving the majority of orders. Compared to prior reports emphasizing automotive dependence, this year’s results suggest a diversification in both sectors and robot applications, which marks a significant difference from trends observed just a few years ago.

What fueled the rise in robot orders?

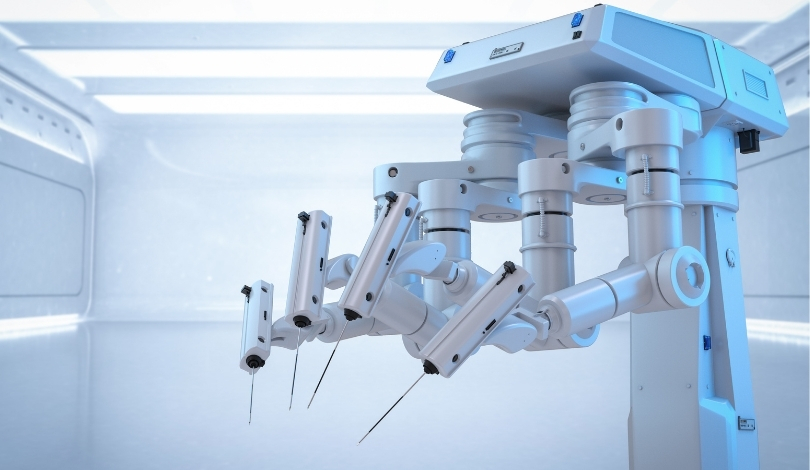

According to the Association for Advancing Automation (A3), North American companies ordered 36,766 robots valued at $2.25 billion in 2025, recording a 6.6% increase in units and a 10.1% rise in revenue from the year before. The organization pointed to a renewed confidence in leveraging automation to address multiple pressures, including workforce needs and increased interest in domestic manufacturing. General industries, such as food, consumer goods, and electronics, made up the largest portion of robot purchases, overtaking traditional automotive buyers. As A3 stated,

“We’re seeing increasing adoption across sectors, especially in general industry applications and at automotive OEMs, as manufacturers look to automation to address workforce shortages, manage reshoring initiatives, and boost productivity.”

Have non-automotive sectors overtaken automotive in robot demand?

Non-automotive sectors led the growth in 2025, showing higher levels of engagement with robotic technologies. The shift was notable, as industries beyond automotive captured more than half of total ordered units for the first time in several years. Even though orders from automotive component manufacturers were lower than in 2024, original equipment manufacturers within the automotive industry did show improved activity, reflecting some stabilization. Robust demand during the fourth quarter—where 10,325 robots worth $579 million were ordered—further propelled annual figures above 2024 and marked the sixth straight quarter of year-over-year growth.

What role did collaborative robots play in 2025?

Collaborative robots, or cobots, comprised a growing percentage of overall robot orders, reaching their highest levels since A3 began reporting them as a separate category. In the fourth quarter, cobots accounted for nearly 29% of units ordered and represented 14.7% of quarterly revenue. For the year, 7,212 collaborative robots worth $241 million were ordered, indicating a steady expansion of cobot deployment across various industries. The association expects increasing adoption of cobots into 2026, suggesting their importance in future automation strategies. As noted by Alex Shikany of A3,

“Combined with steady demand across food, electronics, and other non-automotive industries, this points to a positive outlook for 2026.”

Sector-wide interest in robotics now extends beyond established users, reflecting a maturing market where both small businesses and large manufacturers see automation as an important investment. The transition away from an automotive-dominated order book points to industries recognizing the long-term potential for robots to relieve workforce shortages and streamline production. For companies considering automation, monitoring product adoption—such as for collaborative robots—may reveal which solutions best fit operational needs and budget constraints. Awareness of trends and regular updates from organizations like A3 can assist in strategic planning, ensuring informed investment decisions in a competitive landscape.