After a period of sluggish movement in desktop CPU shipments, Intel has taken a new step to energize the market by introducing financial incentives for retailers to promote its processors. This approach signals a push to recover its competitive positioning, particularly with mounting competition from rivals like AMD. The tech industry has seen fluctuations in demand for desktop components, with consumers increasingly shifting preferences toward mobile and workstation devices. Intel’s strategy unfolds as part of a broader attempt to maintain its relevance in changing market conditions and could influence pricing or availability for end users.

Recent information about Intel’s product lines shows the company previously relied on steady demand in desktop systems, but market research highlights a notable dip in overall sales volumes. AMD’s Ryzen series has made significant advances, compelling Intel to adopt measures beyond traditional marketing or price adjustments. Analysts suggest that while rebates and promotions have been used selectively before, the current bonus incentive appears more targeted and urgent, reflecting heightened stakes in maintaining market share. This compensation plan for partners marks a more aggressive strategy than the incremental adjustments seen over the last year.

What Does Intel’s Promotion Involve?

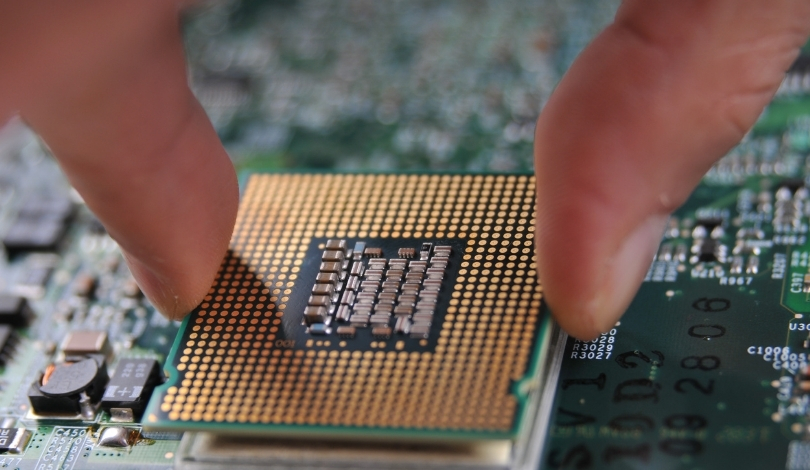

Intel is offering a bonus program to retailers and system builders selling its Core and Core Ultra CPUs. The incentives are structured to reward higher sales volumes of these processors, aiming to motivate partners to prioritize Intel products over competitors. The featured models include both the widely used Intel Core and the recently launched Core Ultra lines, which target both mainstream and high-performance markets.

How Are Retailers Responding to Intel’s Incentives?

Retailers have expressed interest in the opportunity, as additional profits could help offset lower consumer demand. An Intel spokesperson commented,

“We design promotional programs and incentives to help our partners grow their businesses alongside us.”

These programs are being implemented across various regions, and some participating sellers notice an uptick in promotional activities around Intel products.

What Does Intel Expect From This Move?

The company appears to seek a swift recovery in its desktop processor segment, with the bonus plan serving as a central tool to achieve this. Intel’s representative stated,

“We’re committed to collaborating closely with retailers to deliver value for customers and drive adoption of our latest solutions.”

By implementing these incentives, Intel hopes to solidify relationships with partners and regain momentum lost to competing brands.

Industry observers note that direct financial incentives for sales growth can have short-term effects on inventory movement but may not entirely resolve underlying demand challenges if consumers remain cautious. For those in the PC hardware supply chain, such programs could impact stocking decisions and future promotions. Watching Intel’s methods offers a broader view of how legacy technology companies can leverage partner networks to respond to shifts in buyer interest, especially in segments where competition tightens and innovation cycles accelerate. For consumers and industry participants alike, these moves indicate that firms are adapting sales tactics amid evolving market trends.