Efforts to commercialize autonomous trucking gained momentum as Kodiak AI Inc. joined forces with Robert Bosch GmbH. The move is attracting interest across logistics and automotive industries, where reliability and scale are crucial for adoption. With regulations and safety standards evolving, businesses and fleet operators are closely observing these partnerships, evaluating how new technologies may help them streamline operations or address persistent driver shortages.

Recent years have seen several companies, including Waymo and TuSimple, develop self-driving trucking solutions with a focus on pilot programs and limited commercial deployments. Unlike some earlier ventures that emphasized purely custom hardware, Kodiak aims to create a redundant and modular autonomous driving system that can be installed both during manufacturing and as an upgrade, using Bosch’s experience in large-scale automotive supply. Earlier industry collaborations have occasionally struggled to move from pilot phases to broad commercial scalability, highlighting the significance of supply chain and integration experience in this sector.

What Will the Kodiak-Bosch Partnership Deliver?

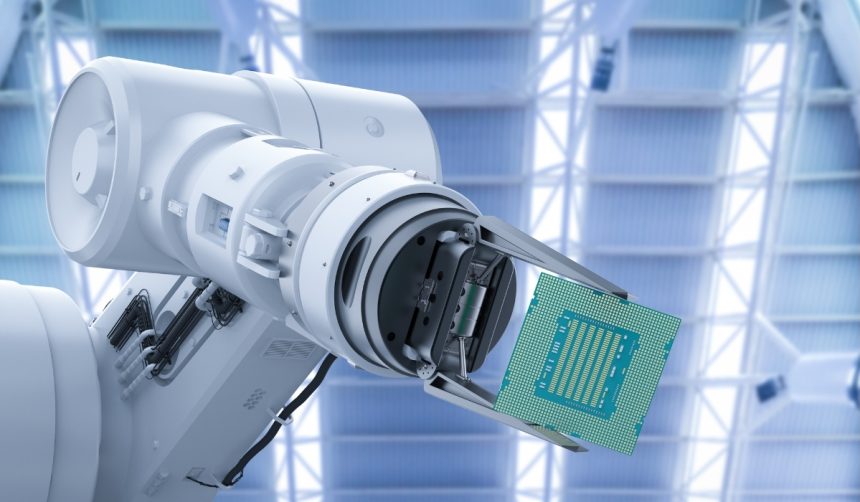

Kodiak and Bosch have entered a collaboration to scale up production of a commercial-grade autonomous platform intended for both truck manufacturers and upfitters. Their system includes a unified package of hardware, firmware, and software interfaces, which powers the Kodiak Driver—an automated driving solution for heavy-duty trucks. Bosch is set to provide an array of production-grade components such as sensors and steering systems, with the objective of facilitating reliable and safe deployment at scale.

How Does This Technology Address Transportation Industry Challenges?

Facing logistics challenges like driver shortages and efficiency demands, Kodiak’s approach blends artificial intelligence with modular hardware in the Kodiak Driver system. By leveraging Bosch’s supply chain and manufacturing expertise, Kodiak anticipates that its solution will be easier to integrate within existing trucking operations and adaptable for both new vehicles and retrofit scenarios. The companies have emphasized flexibility, aiming to meet both fleet operators’ and vehicle manufacturers’ needs as autonomous vehicle adoption grows.

Will the Partnership Influence Broader Autonomous Mobility?

Bosch, recognized as a leading automotive supplier, brings industrial-scale capabilities to develop robust vehicle components critical to autonomous operation. Kodiak’s CEO, Don Burnette, expressed confidence in the partnership:

“We believe collaborating with Bosch will allow us to scale autonomous driving hardware with the modularity, serviceability, and system-level integration needed for commercial success for both upfit and factory-line integration.”

Bosch leaders likewise underscored the value of this collaboration, with Paul Thomas, President of Bosch North America, stating,

“By supplying production-grade hardware, we are enabling the next generation of autonomous trucking alongside Kodiak.”

These statements highlight how both companies see mutual benefit and the opportunity to collect real-world data essential for product refinement and regulatory approval.

The decision to go public through a merger with Ares Acquisition Corp. II marks another step as Kodiak seeks greater resources to accelerate the rollout of its technology. Compared to competitors that may have relied on internal component production or smaller-scale partnerships, Kodiak’s collaboration with an industry giant may help resolve bottlenecks in manufacturing and deployment. Earlier autonomous trucking announcements sometimes struggled to transition from prototype to production due to supply chain or integration issues.

Commercial success in autonomous trucking depends on more than just software innovation—large-scale component supply, vehicle integration, and validated reliability are necessary for adoption. For logistics providers and OEMs considering autonomous vehicles, the Kodiak-Bosch partnership could result in flexible deployment options and lower integration costs. Observers should monitor how quickly and effectively this partnership can transition from demonstration to widespread market availability, and how the collaboration adapts to regulatory, operational, and business realities. Studies indicate that modular, redundant platforms provide an advantage when adapting to varied fleets and operational requirements, especially in an industry as diverse as trucking.